The choice of whether to rent or buy can be perplexing as ever in today’s dynamic housing market. Making this important choice today requires considering a number of factors, including remote work, rising mortgage rates, rising rent, and changing lifestyles. Ideally, it is best to own a home in all considerations. The advantages of buying a home over renting include several tax breaks, the chance to build equity, and of course having a place you can call your own. Moreover, the present housing and mortgage market conditions have produced the ideal window of time for moving from paying rent on a monthly basis to buying your own home.

According to Hale of Realtor.com, renters should prepare to pay more. As the market for buying a home becomes more competitive, those who are unable to compete will likely continue to rent, driving up the demand for rental properties. Economists at Realtor.com anticipate a 6.3% national increase in rents and a 5.4% increase in median home prices.

“Rent growth is predicted to outpace home sales growth in 2022, but moving into 2023, renting may become a less affordable option in some states.”

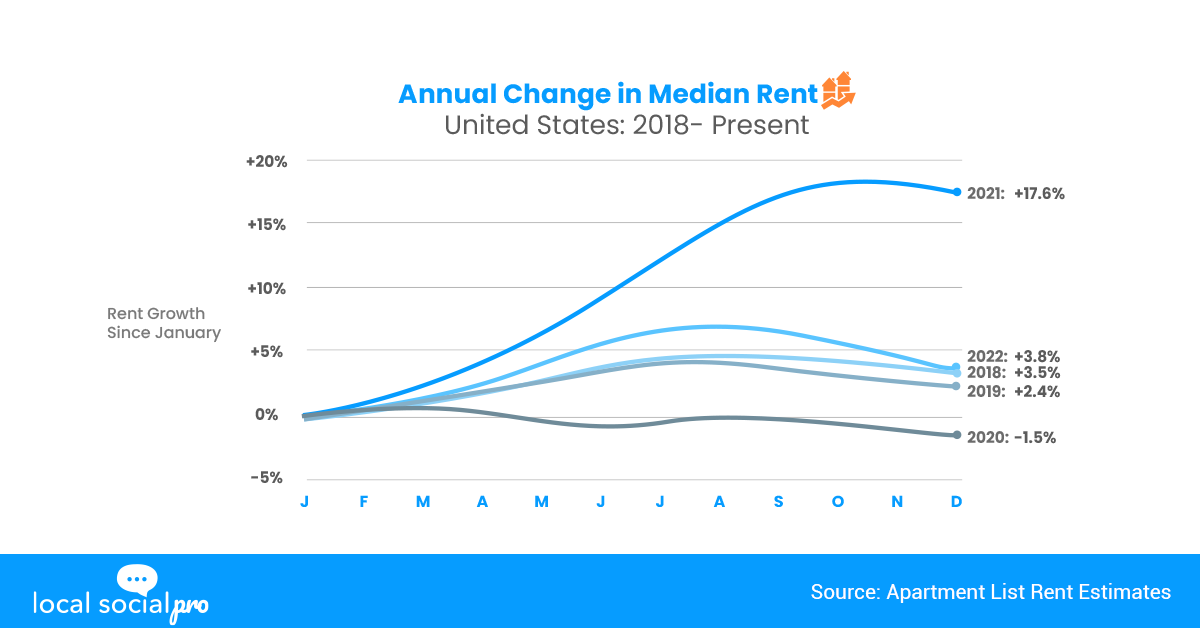

Based on the September 2022 National Rent Report from apartmentlist.com, the national index did in fact increase by 0.5% in August, which is half as fast as the growth was in July. This pattern heralds the market for rentals as adhering to a typical pre-pandemic pattern. Rent inflation increased more quickly than it did in 2021, but it did so much more slowly than it did then. Rent increases by 7.2% in 2022 versus 14.8% at this point in 2021. Growth year over year has decreased from a high point and is now only 10%.

Even though rents were rising, the cost of ownership had increased even more as a result of rising home prices and mortgage rates. On the contrary, those very reasons are suggestions that it’s a good time to buy if you have the finances. The amount of your monthly rent payments may rise over time, but a fixed-rate mortgage will guarantee that it stays the same. Your interest rate is fixed with a fixed-rate mortgage for the duration of the loan.

Buying a home in 2023 might be difficult in markets where the supply is still low. Nevertheless, in markets where prices have dipped, sellers might be more flexible than in the previous few years. Not to mention that as per Realtor.com, almost half of the country’s largest markets still deem first-time homebuying more affordable than renting. Likewise, owning a home is ideal in every way. It is a crucial step toward achieving long-term financial stability.

The Bottom Line

Making the choice between renting and buying a home becomes a little clearer since we anticipate a rise in rent in the near future. Owning your own home and accumulating equity, in the long run, is undoubtedly beneficial to you. Homeownership comes with freedoms and responsibilities, such as making on-time monthly mortgage payments and upkeep of your house. However, you will be looking after your own investment as the property owner.