A new year is fast approaching as 2022 draws to an end. Consequently, now is the ideal time to forecast real estate matters for 2023. It is reasonable to assume that the cost of financing a home won’t be decreasing this year given that interest rates have roughly doubled from their lows in early 2022. However, what about the year 2023? Is there any hope for this dreary scenario?

If you are reconsidering the objectives you set for yourself in terms of purchasing a home next year, here are housing market predictions that will help pave your path to making wise and informed housing decisions.

Housing Market Predictions Through 2023

As 2022 nears its end, housing experts continue to keep a close eye on the economy, which is still being pushed in a variety of directions by persistently high inflation, high-interest rates, and lingering geopolitical concerns. There are signs that the housing market is correcting itself after a couple of booming years, but the process has been slow. Potential buyers find it more difficult to access affordable housing as mortgage rates remain more than double compared to the first week of 2022 and housing prices are more than 6% higher. Hence, a lot of real estate experts caution potential buyers against intending to time the housing market as the economy navigates its current phase of uncertainty.

According to the National Association of Realtors (NAR), the median existing-home sales price was $379,100 in October, up 6.6% from a year earlier but down from the record high of $413,800 in June. The Mortgage Bankers Association (MBA) reports that mortgage applications are at their lowest point in 25 years, reflecting the impact that rising housing costs have had on home buyers. As a result of buyers being “squeezed out of qualifying for a mortgage,” according to Lawrence Yun, chief economist for the National Association of Realtors, total existing-home sales decreased 5.9% from September to October, denoting the ninth consecutive month of falling sales. However, the direction that mortgage rates take from here is heavily influenced by what happens with inflation in the upcoming year.

“…mortgage rates could pull back meaningfully next year if inflation pressures ease.”

– Chief Financial Analyst, Bankrate

All of this, however, might soon change. A more optimistic outlook is expressed by Rick Sharga, executive vice president of market intelligence at ATTOM Data Solutions. In early 2023, he predicts that rates will peak at roughly 8 percent and 7.25 percent, respectively, for 30-year and 15-year loans.

“…then gradually come down over the course of the year somewhat to hang in the range of 6.0 percent and 5.25 percent, respectively. This is entirely dependent on the Federal Reserve’s ability to get inflation under control and ease up on its aggressive rate increases.”

What to Anticipate as a Homebuyer

The historically low mortgage rates fueled an increase in demand, particularly among millennials. However, they are running into a shortage of available housing and now have to face higher rates of close to 6%. Many buyers are still in hope of finding a home that fits their budget and needs. Recent studies have shown that more homes become available as Baby Boomers downsize or leave the market, but the housing stock frequently does not meet the demands, preferences, or budgets of young consumers.

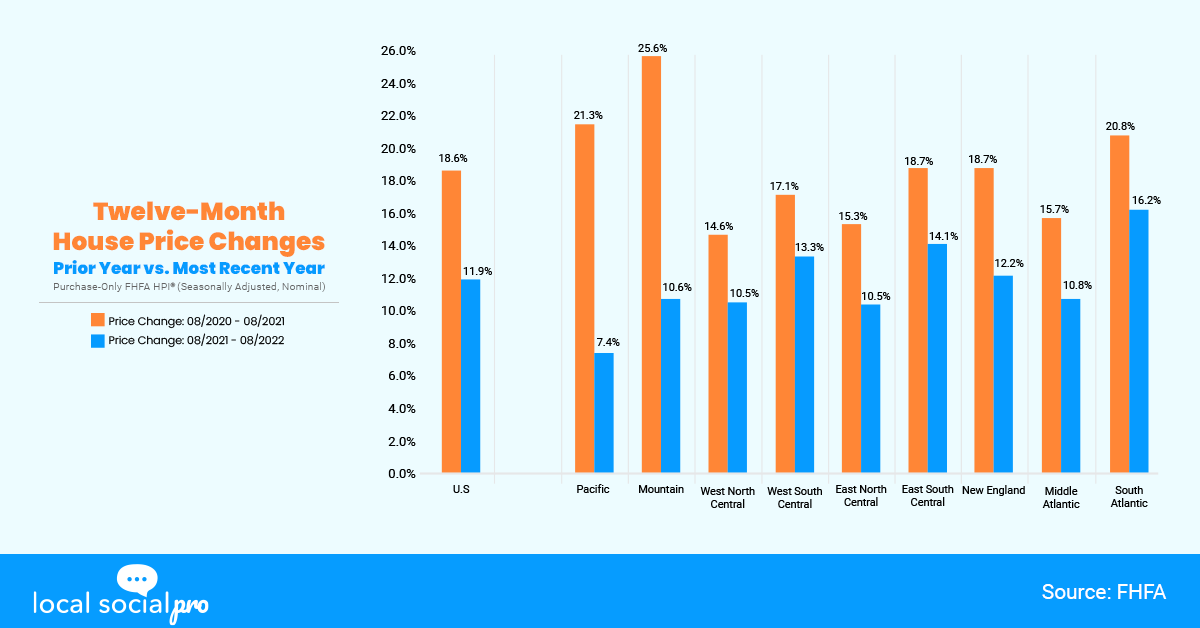

Based on the most recent House Price Index for October 2022 published by the Federal Housing Finance Agency, house prices decreased nationwide in August, falling by 0.7 percent from the prior month. Interestingly, according to Nadia Evangelou, senior economist and director of Real Estate Research for the National Association of Realtors, home prices won’t decrease in 2023 as a result of low inventory. She anticipates that prices will rise by just 1%, remaining largely flat. However, Robert Johnson, a finance professor at Creighton University’s Heider College of Business, believes that higher interest rates will undoubtedly have a negative impact on home prices and values. According to Johnson, there will be “A soft real estate market with prices at levels lower than current levels.” That’s unfortunate for sellers but good news for those looking to buy a home.

Despite popular belief that now is not a good time to buy, many home buyers are looking to lock in their monthly housing payments. 2023 might be a “nobody’s-market” for buyers and sellers, suggests Realtor.com. For consumers who are up for the challenge, success will require a current knowledge of market conditions, creativity, adaptability, and a healthy dose of patience. In 2023, buyers will have a few things to look forward to. Homes will presumably take longer to sell, there will be more homes available, and buyers won’t face the fierce competition that has become customary in the past few years. Their desire for homeownership is comparable to that of earlier generations, and 88% of them are confident they will one day become homeowners, according to Fannie Mae’s research. Between 2018 and 2023, researchers anticipate a 7% increase in single buyers and a 6% increase in married buyers without children. According to the study, 69% of respondents are fine with smaller homes as long as their needs are met. Furthermore, 63% are receptive to older fixer-uppers, viewing them as a more affordable alternative.

The Bottom Line

Taking a broad view of the potential real estate market in 2023, most experts agree that it will likely be a transitional year marked by uncertainty. In any market, buying a house is a very personal choice. Homes are typically the biggest single purchase that a person will make in their lifetime, so it’s important to have a strong financial foundation before committing to a purchase. The best approach to buying a home is not to try to predict what might occur in the upcoming year. However, it’s best to stay updated and informed with the current housing market situation. Your ability to grasp and visualize your housing goals for 2023 will be made possible by having an expert by your side.